-

MARCH VAPA SOM

READ MORE > -

2024 POL Winner

READ MORE > -

WINTER 23 GRANTEES

READ MORE > -

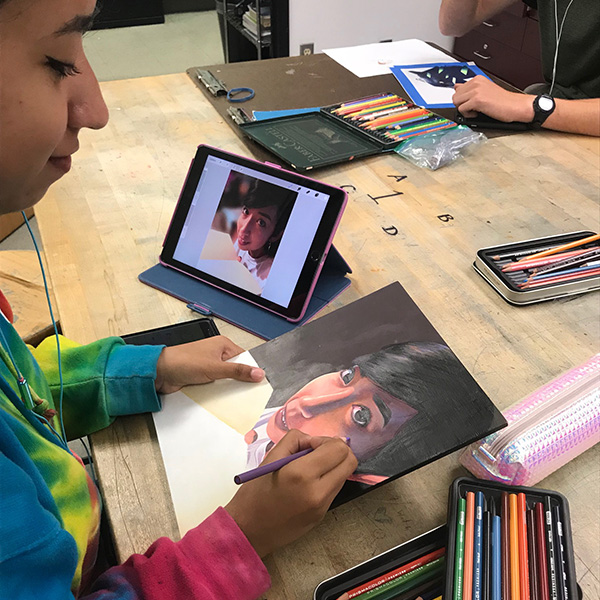

22-23 STUDENTS OF THE YEAR

READ MORE >

- MARCH VAPA SOM

- 2024 POL WINNER

- WINTER 23 GRANTEES

- 22-23 STUDENTS OF THE YEAR